The DSO calculator measures your average invoicing collection process. It shows the average number of days that it’s taking for your customers to pay your invoices. It tells you the number of days it takes for your company to collect a payment from your credit sales.

- Dso Calculation Template Excel Download

- Dso Calculation Template Excel File

- Dso Calculation Template Excel Free

Knowing your DSO figure will show you the average amount of time that it is taking your customers to pay you!

Why calculate your DSO?

Days Sales outstanding = ( Average Receivables / Credit Sales ). 365. Days Sales outstanding = ( 120 / 700). 365 = 62.57. Hence, DSO = 62.57 days. What this indicates is that, For Company A it takes around 19 days to collect money from its customers. In the case of Company B, it takes as high as 63 days to collect money from its customers. I'm looking for the DAX calculation to calculate DSO usisng the Countback Method. Calculation of DSO in Dec: Aug Sep Oct Nov Dec. Net Sales 154 159 167 158 205. Days Calculation. Calculation: Dec 30 405-205=200.

Dso Calculation Template Excel Download

Knowing your DSO not only tells you how long it’s taking for your customers to pay you, but this figure also indicates:

- the amount of sales your company has made during a specific time period

- if your company’s collections department is working well

- if your company is maintaining customer satisfaction

- And if credit is being given to customers that are not creditworthy

You can therefore use your DSO figure as a quick benchmark to make improvements to these key areas within your business.

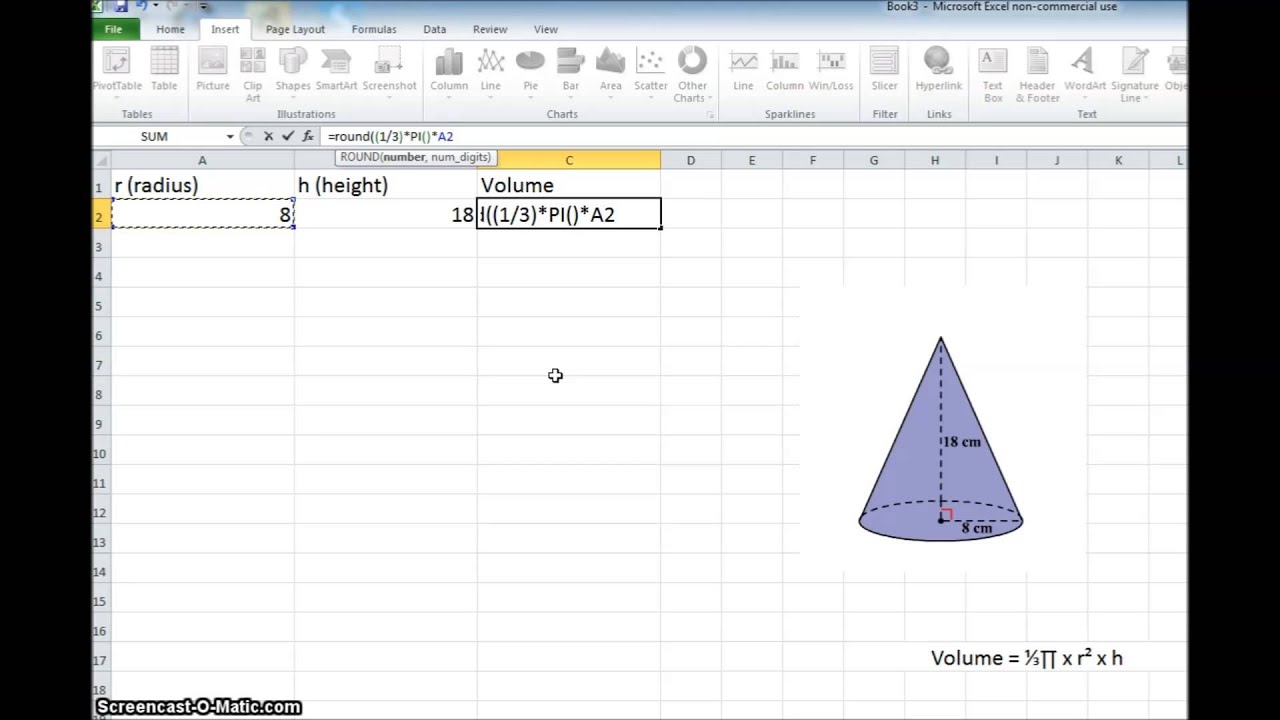

the formula for DSO:

Accounts receivable ÷ Total Credit Sales

× 365 (days in year)

Please enter values without a currency symbol

Dso Calculation Template Excel File

Your DSO number / score shows you the average number of days it takes for customers to pay you.

Dso Calculation Template Excel Free

DSO Calculator Results

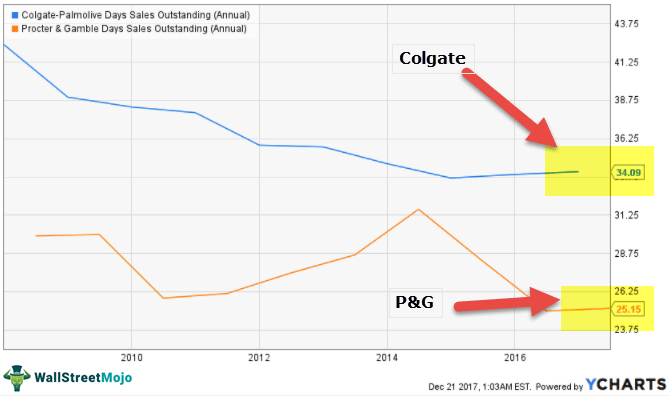

A lower DSO value shows that it is taking you a short amount of time to collect payments for the sales you have made.

A high DSO score shows that it is taking too long to collect payments for sales made. If your DSO is consistently increasing each month, you are heading in the wrong direction and changes need making.

- Do you need to reduce your DSO?

- Want to increase your cashflow?

- Are you wanting to reduce your need for borrowing?